Historical tabs give us the option to record actual collected data that we receive from clients. The trustee gathers this data. When we enter historical data, we refer to it as rolling a deal. This data will affect future projected calculations in applicable fields, but there will be no inner calculations between the fields (more detail below).

- Historical Projects – only appear in deals with a project

- Historical Loans – only appear in deals with loans

- Historical Loans (deal) – only appears in deals with loans

- Historical Bonds – only appear in deals with bonds (securitized)

--

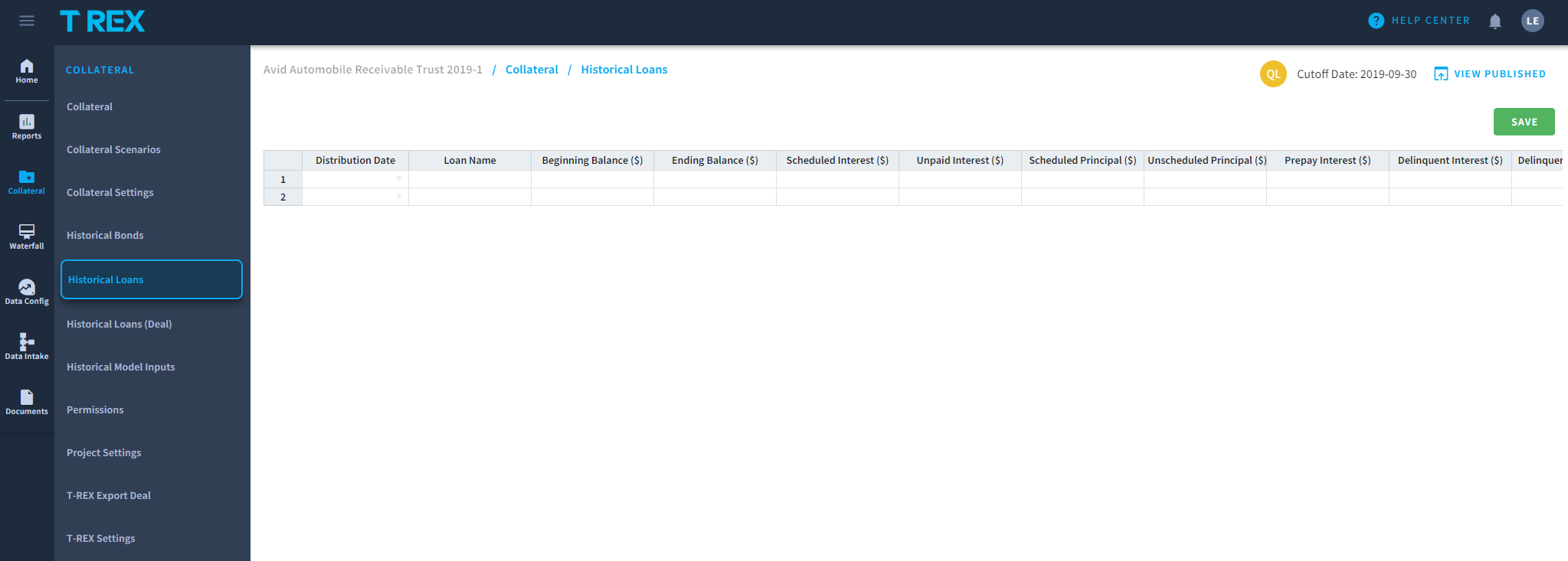

The Historical Loans table is hardcoded, which means the fields that exist will always appear in the editor (unlike the Historical Bond table).

- Mandatory fields: Date, Loan name.

- The Loan name must be identical to the loan name defined under the Collateral editor

- All Collateral that is defined under Collateral editor must be defined per each period

- Periods must be consecutive and start right after the cut-off period (not including)

Note that the numbers provided here are taken as is in the reports, which means when we provide the default amount in the Historical Loans editor, it will not be taken out of the provided balance amount. As the numbers we are provided with have considered the defaults and prepay, there is no need to re-calculate.

Nonetheless, if we receive numbers that do not align with our previous projections, our future projections will consider that and adjust.