How to Create a New Deal

- From the Homepage, click "Add New Deal" or click the [+] button on the left-hand menu. This will open a modal

- There are four supported deal types:

- Securitization - activates all the functionality required to model a securitization.

- Asset Financing - offers similar functionality as the Securitization deal type.

- Data Facility - a specific deal that only shows the connection to deal data and the deal data related reports.

- Warehouse Facility - enables warehouse capabilities based on the Projects asset types.

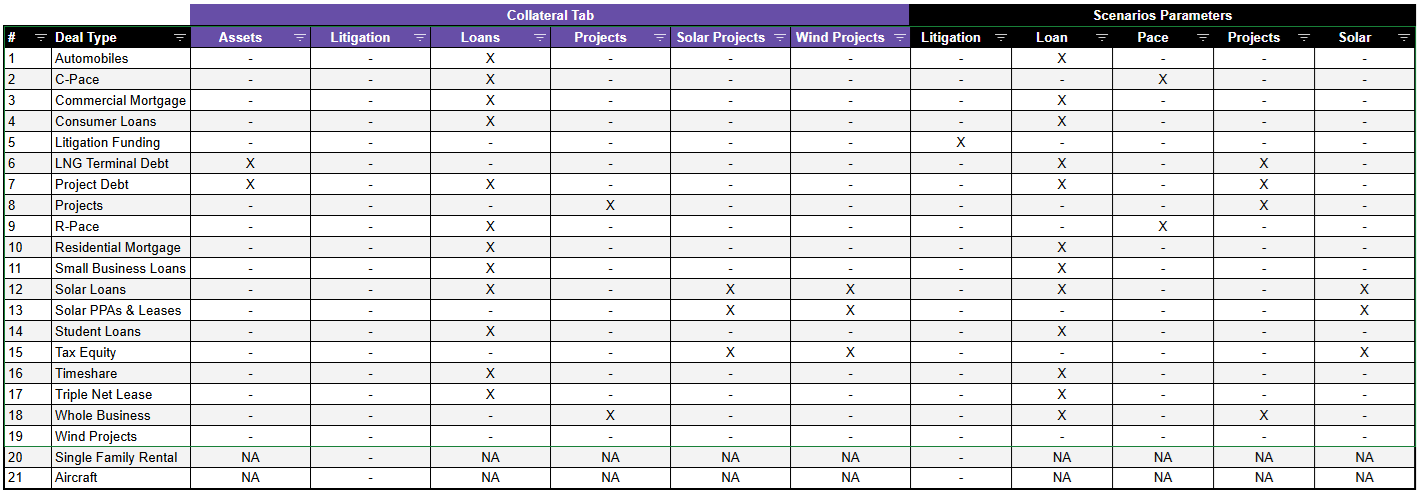

- Once a deal type is selected, you will be prompted to choose the specific asset type. Under Securitization and Asset Financing, the user will find the following asset types.

- After selecting the asset type, you will be prompted to name the deal.

- After clicking "Create," the new deal will open and the user will be directed to the Collateral tab.

Deal Types

TRA offers templates for out-of-the box modeling of the following deal types:

- Aircraft - Currently not supported.

- Automobiles - Automobile Loans based deal - The collateral pool is comprised of loans. The Scenarios tab will display the Loan Parameters.

- C-PACE - PACE-based deal - The collateral pool is comprised of loans. The Scenarios tab will display the PACE parameters.

- CMBS - Commercial mortgage based deal, the collateral is comprised of loans. The Scenarios tab will display the Loan Parameters.

- Consumer Loans - Consumer Loans based deal - The collateral pool is comprised of loans. The Scenarios tab will display the Loan Parameters.

- LNG Terminal Debt - Liquid Natural Gas loan based deal- supported by Projects. The collateral is comprised both assets and loan editors, with Project and Loan parameters in the Scenarios tab.

- Project Debt - Loan based deal- supported by Projects. The collateral is comprised both assets and loan editors, with Project and Loan parameters in the Scenarios tab.

- Projects - Projects deal - supported by Projects, with Project parameters displayed in the Scenarios tab.

- R-PACE - PACE-based deal - The collateral pool is comprised of loans. The Scenarios tab will display the PACE parameters.

- RMBS - Residential mortgage based deal, the collateral is comprised of loans. The Scenarios tab will display the Loan Parameters.

- Single-Family Rentals - Currently not supported.

- Small Business Loans - Small Business Loans based deal - The collateral pool is comprised of loans. The Scenarios tab will display the Loan Parameters.

- Solar Loans - Loan based deal - supported by Solar Projects. The collateral has both solar projects and loan editors. The Scenarios tab will display both Solar projects and Loans parameters.

- Solar PPAs & Leases - Solar Projects deal - supported by Solar Projects, with Solar Projects parameters displayed in the Scenarios tab.

- Student Loans - Student Loans based deal - The collateral pool is comprised of loans. The Scenarios tab will display the Loan Parameters.

- Tax Equity - Tax Equity Solar Projects deal - supported by Solar Projects, with Solar Projects parameters displayed in the Scenarios tab.

- Timeshare - TimeShare Loans based deal - The collateral pool is comprised of loans. The Scenarios tab will display the Loan Parameters.

- Triple Net Lease - Triple Net Lease Loans based deal - The collateral pool is comprised of loans. The Scenarios tab will display the Loan Parameters.

- Whole Business - Whole Business based loans - The collateral pool is made up of whole business projects. The Scenarios tab will display both specific projects and Loans parameters.

- Wind Projects - Wind Projects deal - supported by Wind Projects, with Wind Project parameters displayed in the Scenarios tab.