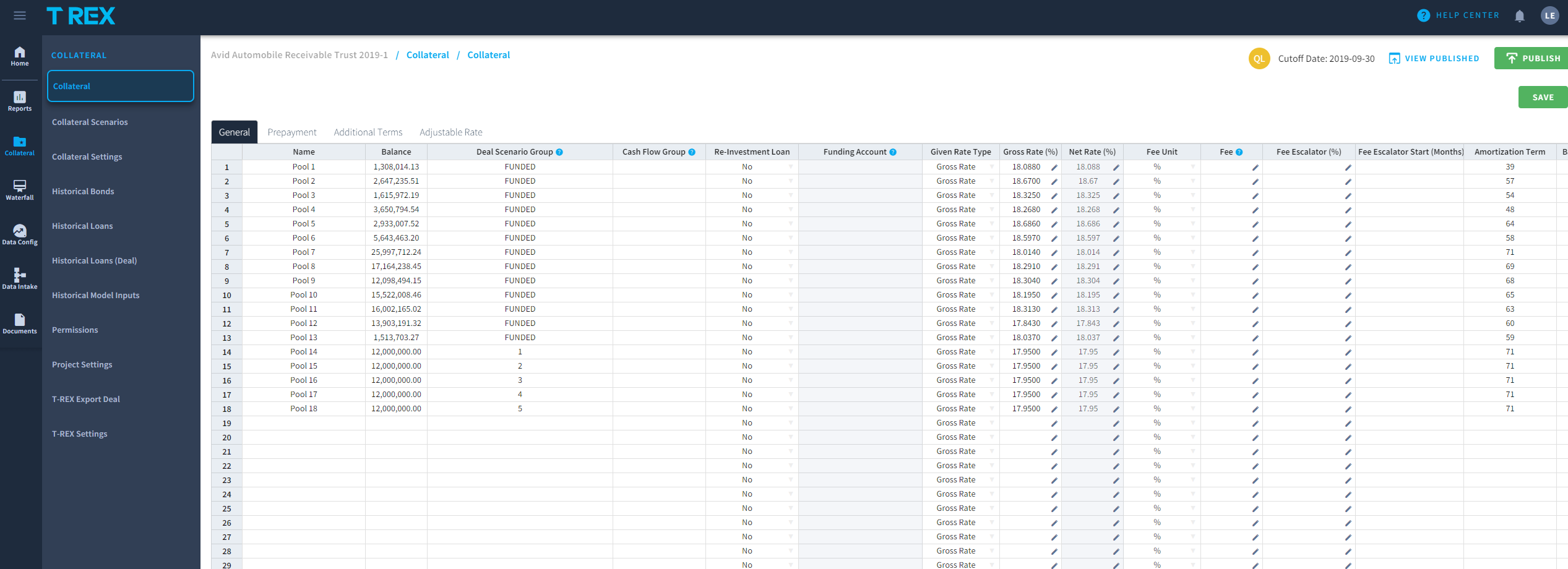

The Collateral editor is available under all loans based projects. This page has four initial tabs:

- General: This tab enables modelers to input basic details to model loans. The minimum information required is: Name (Pool 1, Pool 2, etc), Balance ($1,000,000), the Amortization Term in months, and Gross (Interest) Rate.

- Prepayment: This tab enables modelers to define the prepayment that has already happened or is expected to happen per the collateral. This includes when the prepayment is expected, as well as if there is a previous prepay that should be bundled with the collateral.

- Additional Terms: This tab enables modelers to define additional terms such as a portion of the loan that will be repaid by tax credit (see Tax Credit for a more extensive explanation), or interest from the collateral from before the Cut-Off Date, that will be rolled up within the project as well. Within the Additional Terms section, we can also define the 1st day in which the principal and interest will be paid per loan.

- Adjustment Rate: This tab enables modelers to define an interest rate per loan. This interest rate can be fixed or not fixed. If the interest rate is not fixed, they can be defined to follow a specific index. These index rates are set under market rates (but are only initialized when we defined here).

Solar Specific Tabs

The Use Asset Cash flows tab is only applicable when modelers enable the Solar Debt deal template (a project that has both project finance and loans characteristics, which is currently not supported in generic asset deals).

The user can define the terms in which a specific loan is using CF that originate from a project that is defined in the projects tab. This connection is formed by defining the project ID in the supported projects field. The user can define whether the asset CF from the projects will pay down the principal of the loan, if it will pay partially, fully, on schedule, etc. (the user can define more than one project per loan, by separating them using a comma).

Other

Reserve The Reserve can be used to define specific reserves per loan. The user can determine how to use these reserves, whether to use them to cover the interest portion of the loan or the principal, the balance, target, etc.

Field Definitions